Close

You have found your dream home, navigated offers and inspections, and finally landed a contract. Now comes the big day: closing. While the entire home buying or selling process can feel daunting, I believe understanding the process can help alleviate some of that stress. I know when I was buying my home, no one really walked me through the process of preparing for the closing or explained to me what to expect on the closing day. I hope this post provides you with some explanation of the process.

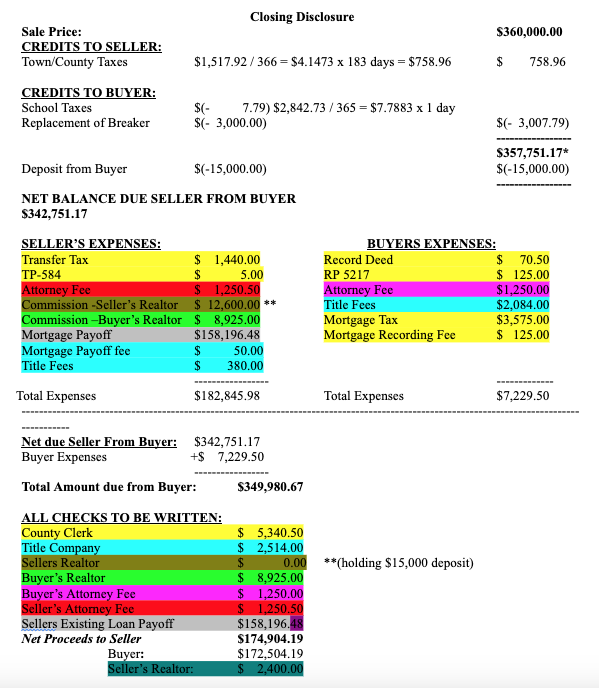

One of the most important documents relating to closing is the Closing Disclosure (“CD”). This document details all the closing costs for which you’ll be responsible. The exact amount you’ll pay will depend on several factors, including Loan Type, Home Price, and Location.

The typical closing costs you might encounter in New York include:

Typically, the seller, buyer, and lender (if applicable) will produce their own CDs prior to closing. Each party’s CD can be stylistically different, but the figures should match. The parties exchange their CDs to confirm an understanding of the closing fees and confirm the checks required to close. Below is an example of a Closing Disclosure. I have color-coded the expenses each party is responsible for in this example to more easily show how they are totaled in the checks to be written section. For example, the fees highlighted in yellow are all fees that are to be paid to the County Clerk, which are then totaled in the County Clerk portion (which is highlighted in yellow) in the Checks to Be Written section.

As you can see above, the first calculation on this CD is Credits to Seller. In this transaction, the only credit due to the seller was Town and County taxes the seller had pre-paid for the year. Because the Seller has already paid town and county taxes for the year but will not own the home for the duration of the tax year, the Buyer owes them a credit calculated based on the closing date. As you can see in this example, the Seller credited for 183 days’ worth of taxes.

The second calculation is Credits to Buyer. In this particular example, the annual school taxes were $2,842.73. Based on the closing date, the seller owed the buyer a credit for the equivalent of one day of school taxes. Note: town and county taxes are typically due at a different time than School Taxes. Here the closing date fell one day after the school tax period ended.

In addition to the single day of school taxes, the parties agreed that the seller would offer a $3,000.00 credit to resolve an issue discovered during the inspections.

The next portion of the CD breaks down each party’s expenses. These expenses are color-coded to help understand the checks to be written for the closing. The most complex calculations are the fees owed to the County Clerk and the title company. In this example, the fees to the County Clerk include transfer taxes and fees associated with filing certain required documents. The required documents typically include:

While the CD can seem complex, it is simple once you understand each section. However, every transaction and locality is different, and the example above is only meant to demonstrate what you could encounter when preparing for closing. We strongly recommend seeking an experienced attorney to guide you through this process.

Once the CDs have been reconciled, it is time to close! Usually, the closing will occur at either the Seller’s attorney’s office, the lender’s office, or the lender’s attorney’s office. While it might sound obvious, you should confirm the location and time of the closing, so you are not scrambling the day of. Typically, all the parties will attend the closing; however, sometimes, the seller will sign the required documents in advance of the closing and not attend the closing, which is acceptable.

At the closing, the attorneys will discuss and exchange documents for the parties to execute. If the buyer is using a mortgage to purchase the property, their lender will typically require them to sign a promissory note (legally binding agreement that outlines the terms of the loan), mortgage (creating a lien on the property), Affidavits and Declarations (swearing the accuracy of the information you have provided) and Escrow Documents (related to establishing an escrow account to fund taxes and insurance fees). Depending on the type of mortgage and the lender, this process can vary.

Assuming the buyer has taken a mortgage, in my experience, once the buyer has executed the lender’s documents, the parties execute the remaining documents, including the TP-584, RP-5217, and the deed (executed only by the seller). Typically, the parties then exchange the pre-written checks based on the CDs’ calculations, and the buyers are provided with the keys to the property, and the transaction is closed! While this might sound anticlimactic, much of the work is completed before the closing.

While this blog is meant to help explain an example CD and what to expect at a residential real estate closing, endless variables can change what has been described above. No transaction is the same, so I encourage you to hire an experienced real estate attorney to help guide you through this process.

Here at Kelly and Sellar Ryan, PLLC, we take pride in guiding both buyers and sellers through the intricacies of a real estate transaction. Anyone with questions about the information contained in this post can contact Attorney Thomas M. Morelli at (518) 692-1200 or tmm@ksrpllc.com.

Disclaimer: The information you obtain on this website is not, nor is it intended to be legal advice. You should consult an attorney for advice regarding your individual situation. We invite you to contact us and welcome your calls or communications. However, contacting us does not create an attorney-client relationship. Some of the content herein is attorney advertising. Prior results do not guarantee similar outcomes.